The Forex Daily Analysis for August 9, 2025 reflects heightened volatility after mixed economic data and shifting central bank sentiment. Traders are digesting the latest Non-Farm Payroll (NFP) report, anticipating the upcoming FOMC meeting minutes, and eyeing inflation readings from CPI.

In today’s Forex Daily Analysis, we’ll break down technical and fundamental setups for EUR/USD, GBP/USD, and XAU/USD, followed by actionable trading scenarios for the short term.

Technical Analysis

EUR/USD

Daily Chart Overview:

The EUR/USD pair is trading around 1.1080, holding above its 50-day moving average but facing resistance at the 1.1125–1.1140 zone.

- Resistance Levels: 1.1125, 1.1180, 1.1220

- Support Levels: 1.1050, 1.1015, 1.0970

Technical Indicators:

- RSI (14): 58 — suggesting mild bullish momentum without overbought conditions.

- MACD: Histogram is positive but flattening, indicating potential consolidation before a breakout.

- Price Action: A bullish flag is forming, but failure to hold 1.1050 could lead to a deeper retracement.

Outlook: Bias remains mildly bullish if price sustains above 1.1050, targeting 1.1180 in the short term.

According to today’s Forex Daily Analysis, EUR/USD shows a mild bullish bias as long as 1.1050 holds, with upside potential toward 1.1180.

GBP/USD

Daily Chart Overview:

GBP/USD is hovering near 1.2985, supported by a recent rebound from the 1.2900 level but capped by resistance near the psychological 1.3000 mark.

- Resistance Levels: 1.3000, 1.3045, 1.3100

- Support Levels: 1.2940, 1.2900, 1.2855

Technical Indicators:

- RSI (14): 61 — bullish territory, close to overbought.

- MACD: Bullish crossover intact, but momentum is slowing.

- Price Action: The pair has formed higher lows since late July, suggesting an uptrend continuation if 1.2940 holds.

Outlook: A daily close above 1.3000 could open the way to 1.3100, while a break below 1.2900 may shift momentum bearish.

Our Forex Daily Analysis suggests GBP/USD may extend gains if 1.3000 is cleared, but caution is warranted near overbought levels

XAU/USD (Gold)

Daily Chart Overview:

Gold is trading near $2,345/oz, consolidating after a sharp rally driven by risk-off sentiment earlier in the week.

- Resistance Levels: $2,355, $2,372, $2,400

- Support Levels: $2,330, $2,315, $2,290

Technical Indicators:

- RSI (14): 64 — bullish but nearing overbought.

- MACD: Positive with strong histogram bars, indicating bullish momentum.

- Price Action: Gold is forming a bullish continuation pattern on the 4H chart, suggesting a possible breakout if $2,355 is cleared.

Outlook: A sustained break above $2,355 could trigger a move toward $2,400. However, failure to hold above $2,330 might invite selling pressure toward $2,315.

Today’s Forex Daily Analysis highlights gold consolidating near $2,345, with a potential bullish breakout above $2,355

Fundamental Analysis — Key Events This Week

A core part of Forex Daily Analysis is linking technical setups with fundamentals. This week, NFP data, FOMC minutes, and CPI will dictate momentum across USD pairs and gold.

Non-Farm Payrolls (NFP) — August 8, 2025

The July NFP report showed +215K jobs added, above the forecast of 190K, while unemployment ticked down to 3.7%. However, wage growth slowed to 0.3% MoM, easing inflationary pressure.

Market Impact: The stronger jobs data supported USD early in the session, but softer wage numbers kept expectations for aggressive Fed tightening in check.

FOMC Meeting Minutes — Scheduled August 13, 2025

Traders are awaiting the FOMC minutes for insight into the Fed’s September rate decision. Markets are pricing in a 60% chance of a 25bps cut as inflation continues to moderate.

Potential Market Reaction:

- Dovish tone: Could weaken USD and boost EUR/USD, GBP/USD, and gold.

- Hawkish tone: Could strengthen USD and pressure risk assets.

CPI Data — August 14, 2025

US CPI for July is forecast at 3.0% YoY, down from 3.2% in June. A lower reading would further solidify the case for Fed easing, while an upside surprise could trigger USD buying.

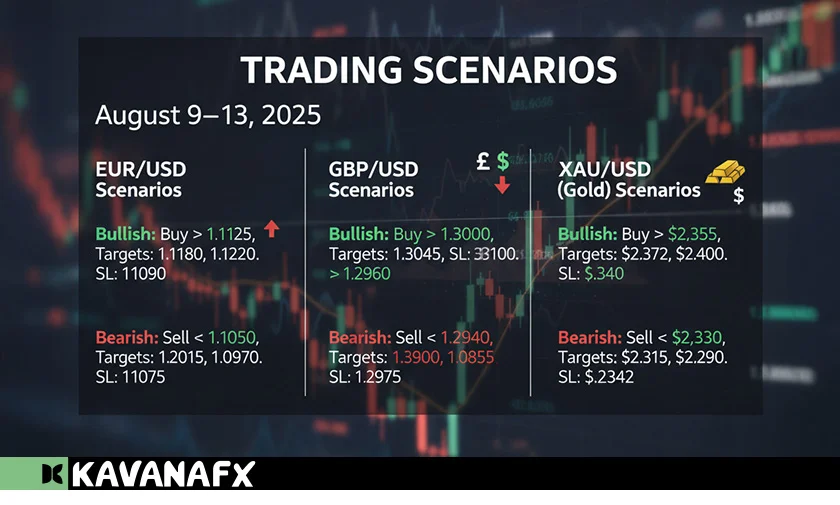

Trading Scenarios for August 9–13, 2025

EUR/USD Scenarios:

Bullish:

- Enter long on a break above 1.1125 with targets at 1.1180 and 1.1220.

- Stop-loss: 1.1090.

Bearish:

- Enter short on a break below 1.1050 with targets at 1.1015 and 1.0970.

- Stop-loss: 1.1075.

GBP/USD Scenarios:

Bullish:

- Buy above 1.3000 for targets at 1.3045 and 1.3100.

- Stop-loss: 1.2960.

Bearish:

- Sell below 1.2940 for targets at 1.2900 and 1.2855.

- Stop-loss: 1.2975.

XAU/USD (Gold) Scenarios:

Bullish:

- Buy above $2,355 for targets at $2,372 and $2,400.

- Stop-loss: $2,340.

Bearish:

- Sell below $2,330 for targets at $2,315 and $2,290.

- Stop-loss: $2,342.

Conclusion

Today’s forex daily analysis suggests a cautiously bullish bias for EUR/USD, GBP/USD, and XAU/USD heading into next week’s high-impact events. Traders should keep an eye on the FOMC minutes and CPI release, which could set the tone for the remainder of August.

Tip: Always combine technical setups with fundamental drivers for a complete forex market outlook. Manage risk carefully, as sudden price moves are common during macroeconomic announcements.

FAQ — Daily Forex Market Analysis

Q1: What is the main driver for today’s forex market?

Today’s moves are influenced by yesterday’s stronger-than-expected NFP numbers and the anticipation of next week’s FOMC minutes and CPI release.

Q2: Which currency pairs are most impacted?

EUR/USD and GBP/USD are showing moderate bullish momentum, while XAU/USD is consolidating near a key resistance level.

Q3: How should traders prepare for next week?

Monitor upcoming economic releases, keep positions sized conservatively, and consider reducing exposure ahead of high-impact events like the FOMC minutes.

Ready to Trade with Confidence?

Stay ahead of the market with our expert forex daily analysis and real-time trading tools. Open your free demo account with KavanaFX today, test strategies risk-free, and access live market data for EUR/USD, GBP/USD, XAU/USD, and more.

Start Your Free Demo Account Now[link]